|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home with Bad Credit: Understanding Your Options and What to ExpectRefinancing your home can be a strategic move to reduce monthly payments or take advantage of lower interest rates. However, if you have bad credit, this process might seem daunting. Understanding your options and what to expect can make the journey smoother. Understanding Refinancing with Bad CreditWhen considering refinancing, it's crucial to comprehend how bad credit can affect your options. Typically, bad credit is considered a score below 620. Lenders may see you as a higher risk, potentially leading to higher interest rates. Factors Lenders Consider

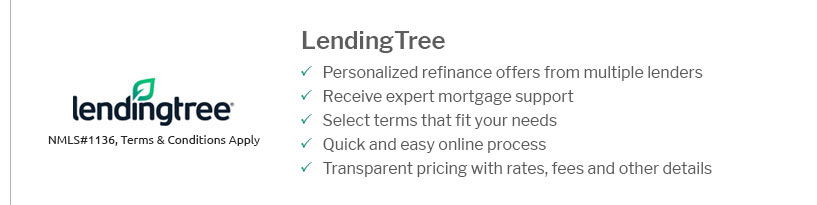

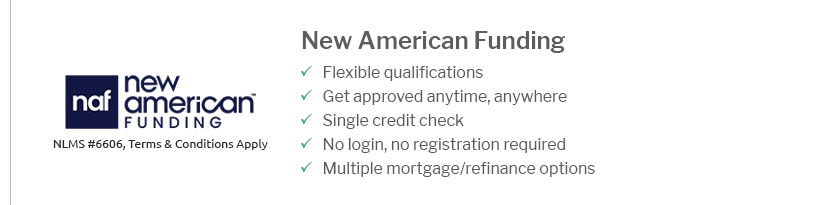

Exploring various lenders and their offerings is vital to find the best terms available. For instance, some might specialize in helping those with poor credit. Steps to Refinance with Bad Credit

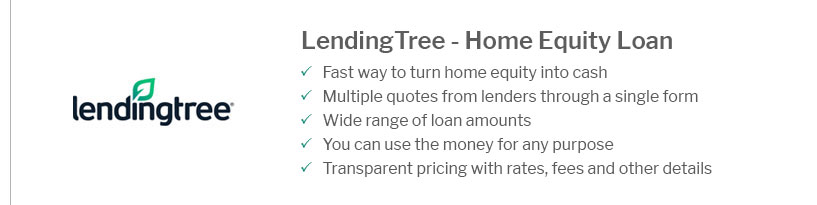

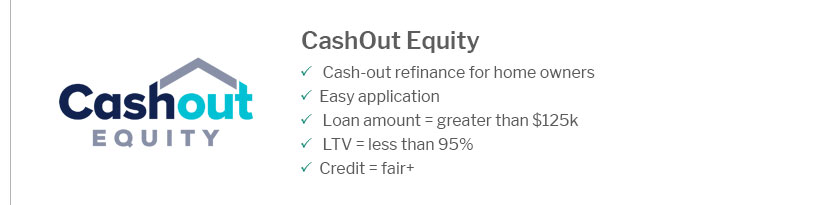

Types of Refinancing AvailableThere are several refinancing options to consider, each with its own benefits and drawbacks. Rate-and-Term RefinanceThis is the most common type of refinancing, where the main goal is to change the interest rate or loan term. However, with bad credit, you might face higher rates. Cash-Out RefinanceThis allows you to take out a new mortgage for more than you owe and take the difference in cash. It's essential to have significant equity to qualify, especially with poor credit. If you're exploring unique options, such as a refinance seller financed mortgage, ensure you understand the specific terms and conditions involved. FAQsCan I refinance my home with a credit score of 580?Yes, it is possible to refinance with a credit score of 580, but your options might be limited. You may face higher interest rates and fewer lenders willing to work with you. It's beneficial to shop around and consider improving your credit score before applying. What are the benefits of refinancing with bad credit?Refinancing with bad credit can still offer benefits, such as reducing your monthly payments, switching from an adjustable to a fixed rate, or even tapping into home equity. It's crucial to weigh these benefits against the potential cost of higher interest rates. How can I improve my chances of being approved for refinancing?To improve your chances, focus on paying down existing debts, making consistent payments, and correcting any errors on your credit report. Additionally, having a stable income and significant home equity can enhance your application. https://www.youtube.com/watch?v=Fk0YH2cwkCA

You can get cash out of your house with bad credit. In this video, I explain how to get a cash out refinance with bad credit for different ... https://www.experian.com/blogs/ask-experian/how-to-refinance-a-mortgage-with-bad-credit/

In this article: ... It's common for mortgage lenders to require a credit score of 620 or above to get approved for a refinance loan. As a result, ... https://www.dsldmortgage.com/blog/refinance-mortgage-with-bad-credit/

Refinance Mortgage With Bad Credit: A Comprehensive Guide ... Yes, it is possible to refinance a mortgage with bad credit, but it can be more ...

|

|---|